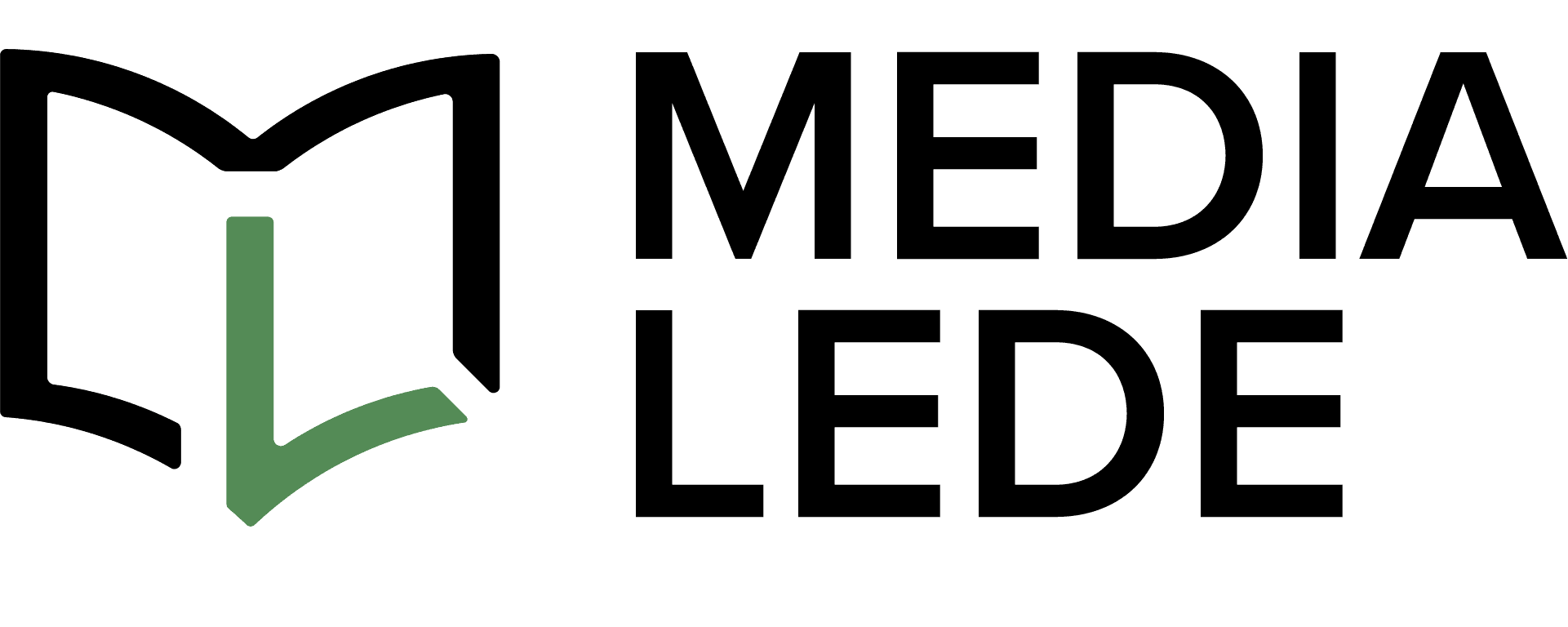

During Piyush Gupta’s last Annual General Meeting as CEO in March 2025, he showed a slide that blew me away.

Of course, one can definitely credit DBS’ multiyear structural transformation for this. But today, I’d like to focus more on the role of healthy investor relations, which has accelerated their market cap growth, in comparison with other banks.

I remember a recent conversation with my mother when she asked me what she should invest in. She asked,

DBS? Their share price has gone up a lot.

I was surprised. Even my mum knew about DBS’ share price.

But DBS has really focused on 4 key strategies to raise their market cap.

Raise awareness amongst the everyday consumer, with promotions everywhere

In 2023, DBS introduced a strange promotion. For the first time, buyers would get a $3 cashback when they paid at hawkers. No questions asked. Pay $3, get $3 back.

Straight into your account. No hoops, no tricks, just money in your wallet. That really started a stampede. From 6am, you would see people scrambling to scan the hawker’s QR code, so that they could get the $3 back.

Then in 2025, Singapore’s 60th birthday, they introduced even more promotions at the likes of coffeeshops like BreadTalk, and grocers like Sheng Siong. Ordinary people knew even more about them now.

Now now, you might tell me, don’t other banks also do that? What makes DBS different, and what has resulted in its growth in share price over and above its peers? Yes, structural transformation has contributed.

Consistency in in-person marketing, making the ordinary merchants their brand advocates

What has differentiated DBS from other retail banks in Singapore is its consistency in introducing these promotions.

A few weeks ago, I was at Nex when I saw a long queue at OCBC. There was a balloon vendor, and a rice store lookalike in the branch offering free rice.

The promotion was their Time Deposit rates. OCBC does this every few months, but these in person events are often few and far between.

Compare this to what DBS does. It’s frequent, punchy, and easily memorable. $3 cashback every Saturday. Who can’t remember that? More importantly, they have made these merchants their biggest advocates. Go to these hawkers, and they will quickly tell you how to scan, and even when it has run out. It keeps DBS at the forefront of people’s minds.

But if we look at it from a retail investor point of view, the consistent question to ask is,

how do you bridge the retail consumer to becoming a retail investor?

Considering that your meepok (or minced pork noodles) might be $5, and $2 with the cashback, but if the minimum size of DBS shares is $5000, at today’s market price?

You need to seed the idea of investing in your target audience’s mind.

Use inception to seed the idea of investing

Take the idea of PropNex Monopoly, introduced by the property agent company PropNex. Through that game, they quickly seed the idea that one should invest in property. And occasionally, when one opens a chance card, they would see

Receive $200 Dividends from shares

It’s a simple way to seed the idea of investing.

Yes, not everyone can introduce a Monopoly game like PropNex, but every company does have the opportunity to introduce the value proposition of your company through your in-person events.

For example, when I attended PropNex’s Property Wealth System, then Deputy CEO Kelvin used the example of buying DBS shares at least 3 times to illustrate when one could never know when the right time to enter the market was.

But probably the most important thing that bridges the retail consumer into a retail investor is the Annual Report.

Use the Annual Report

You might think:

Who reads such a thick set of papers and boring financial statements?

You’d be surprised.

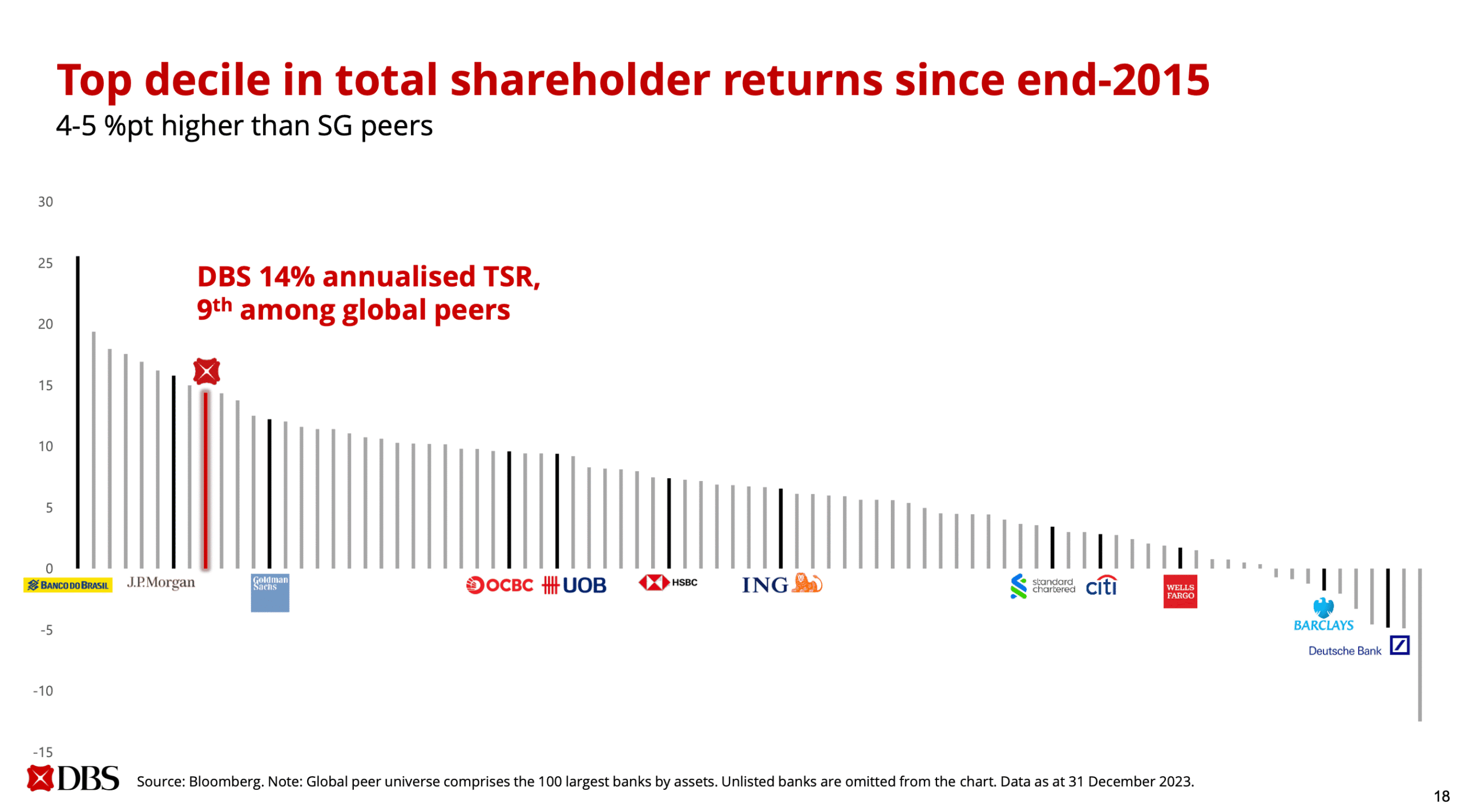

I did a quick search of the keyword ‘Annual Reports’ in a SEO tool. You’d quickly find that just for DBS alone, there are 1200 searches a month. That’s a big number.

The annual report is your first contact with potential investors, whatever the size of the assets these investors can invest with. Whether it be a billion dollar hedge fund, or a $5000 aunty that’s looking to invest with you, the annual report will still be the first marker they use to assess you.

After all, where else can you see a company’s numbers beyond their annual report?

It’s probably why over and over again, DBS’ excellence in communicating (particularly through its annual reports, and evidenced by the prizes it has won for its annual reports), has allowed it the chance to grow its market cap so significantly.

Ignore the annual report at your peril.